how it works

Check out these clear, detailed 3 steps to Securing Funding for your Business.

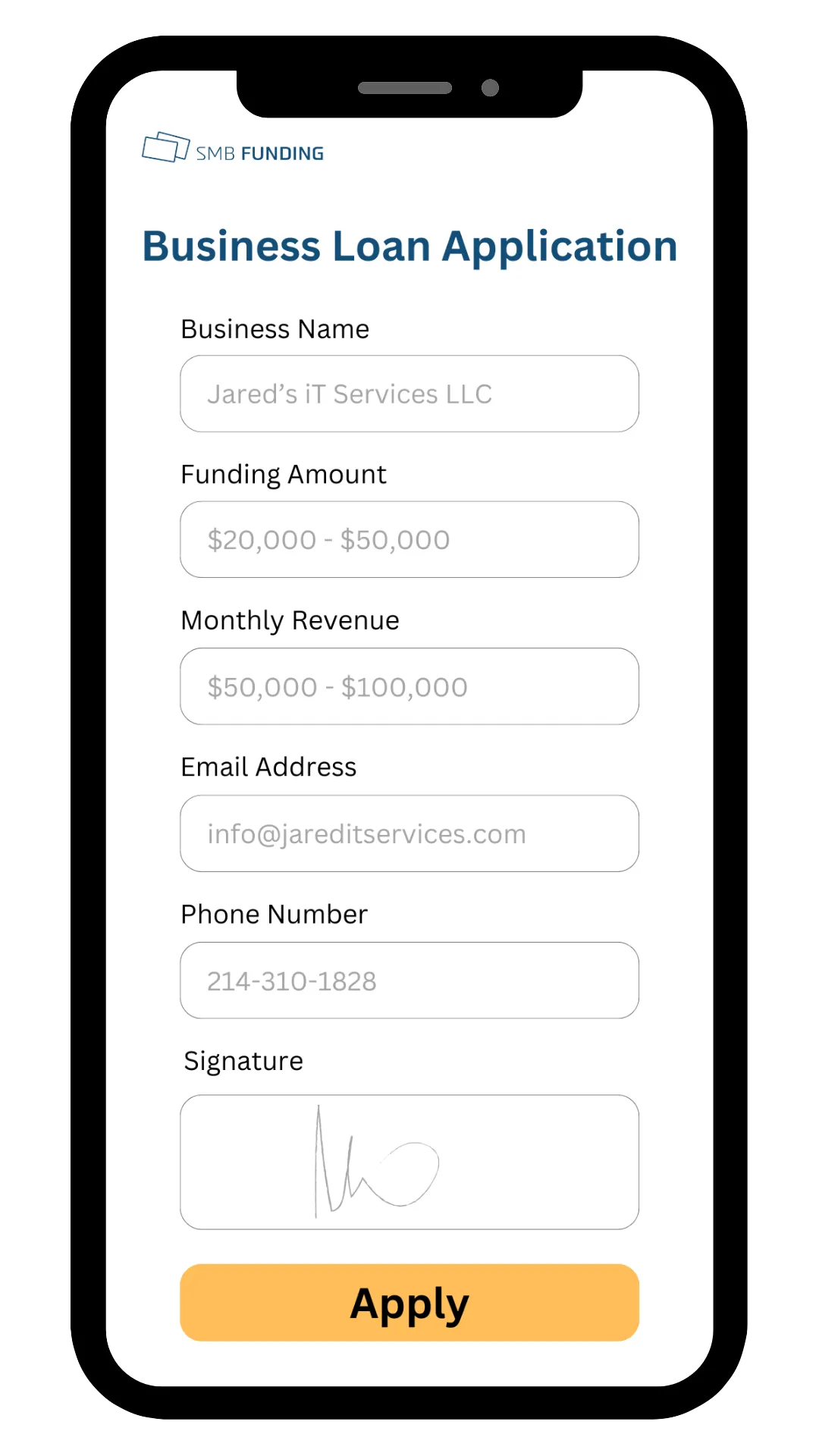

1. Apply Online – it takes less than 5 Minutes

Getting started with your business funding journey is as simple as filling out our quick online application form. The process is designed to be straightforward, taking less than two minutes to complete. You’ll need to provide basic details about your business, such as its name, contact information, and a brief description of your funding needs. There’s no paperwork involved, and you can complete the application from the comfort of your home or office. Once submitted, you’ll immediately begin the process of securing the financial support your business needs to grow and thrive. This hassle-free step ensures that applying for funding is fast, accessible, and stress-free.

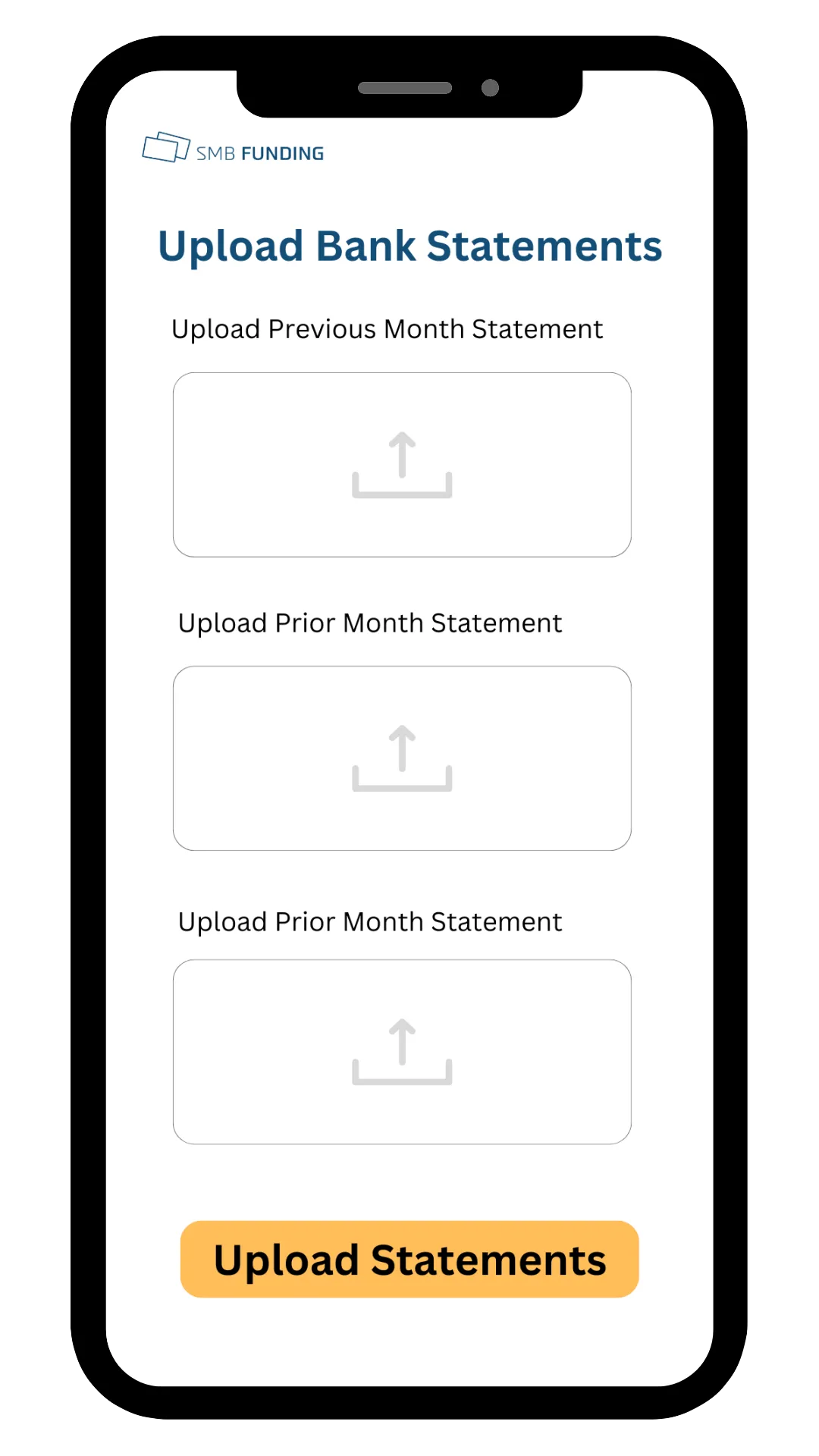

2. Upload your last 3 Months Bank Statements

To expedite the review process, we require your most recent three months of bank statements. This step is crucial as it allows us to assess your business’s financial health and determine your eligibility for funding. The upload process is secure and user-friendly, ensuring your sensitive information remains protected. With these documents, our team can quickly review your application, saving you from unnecessary delays. Providing this information upfront enables us to focus on getting you approved as swiftly as possible. By completing this step, you move one step closer to receiving the funds your business needs.

3. Receive Funding the Next Business Day

Once our underwriting team reviews your application and supporting documents, you’ll receive a decision the same day. Upon approval, your funds will be deposited into your account as early as the next business day. This rapid turnaround ensures you have access to the resources you need without prolonged waiting periods. Whether it’s covering operational expenses, expanding your business, or seizing new opportunities, you can act quickly with the funding in hand. Our goal is to provide a seamless and efficient funding process so you can focus on what matters most growing your business.